In the rapidly evolving landscape of SaaS finance, mastering revenue recognition, deferred revenue, and revenue timing is no longer just an operational necessity—it’s a strategic advantage. Recent data from EY reveals a striking trend: 78% of Series A–C SaaS CFOs outsource their revenue recognition tasks to navigate the complexities of ASC 606 compliance. This statistic not only highlights the challenge but underscores the urgency for SaaS controllers and finance leads to fortify their understanding and strategies around these critical financial measures.

Effective management of revenue recognition and deferred revenue can significantly impact a SaaS company’s financial health, investor relations, and regulatory compliance. With the right insights and approaches, finance professionals can avoid common pitfalls associated with revenue recognition SaaS practices, thereby streamlining their path to ASC 606 compliance. This article aims to equip SaaS controllers and finance leads with actionable knowledge and strategies to optimize their revenue recognition processes, ensuring financial accuracy and operational excellence.

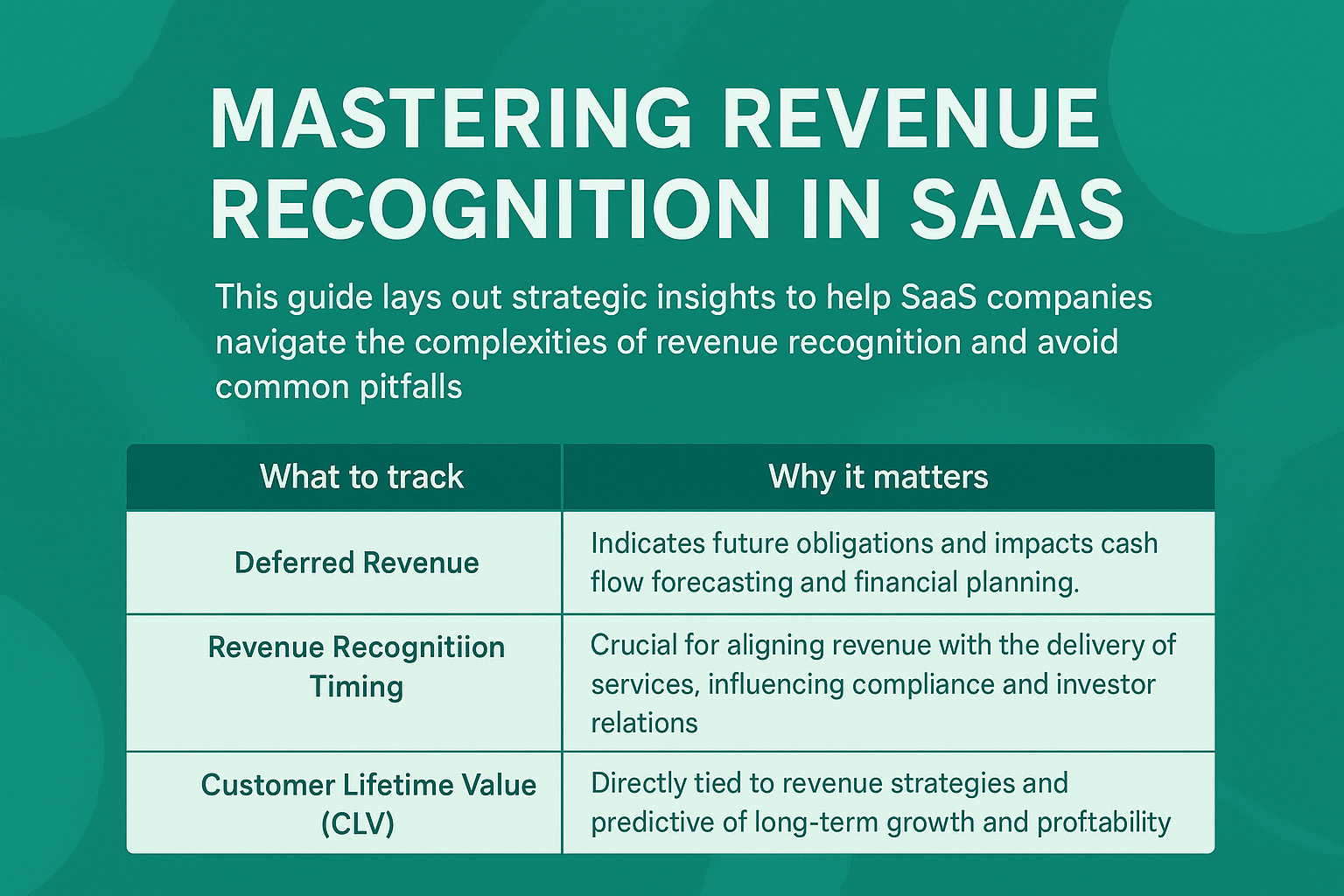

In the dynamic world of SaaS, mastering revenue recognition SaaS, deferred revenue, and revenue timing is crucial for maintaining financial health and ensuring compliance with ASC 606 standards. This guide lays out strategic insights to help SaaS companies navigate the complexities of revenue recognition and avoid common pitfalls, setting the stage for a deeper understanding of key metrics that drive success.

| What to track | Why it matters |

|---|---|

| Deferred Revenue | Indicates future obligations and impacts cash flow forecasting and financial planning. |

| Revenue Recognition Timing | Crucial for aligning revenue with the delivery of services, influencing compliance and investor relations. |

| Customer Lifetime Value (CLV) | Directly tied to revenue strategies and predictive of long-term growth and profitability. |

Understanding the Basics of Revenue Recognition in SaaS

Revenue recognition in SaaS involves complex guidelines that dictate when and how revenue should be reported. The heart of the challenge lies in aligning revenue with the delivery of services, particularly when dealing with subscriptions, deferred revenue, and revenue timing.

For SaaS companies, the essence of ASC 606 compliance is recognizing revenue as performance obligations are satisfied, not necessarily when cash is received. This foundational shift demands a robust system for tracking performance obligations, customer contracts, and revenue schedules. Implementing a systematic approach to revenue recognition is crucial for accuracy in financial reporting. For more insights, explore our guide on SaaS financial forecasting.

Strategic Importance of Deferred Revenue Management

Deferred revenue, or unearned revenue, represents a prepayment from customers for services yet to be delivered. It’s a liability on the balance sheet and crucial for SaaS companies as it directly impacts cash flow and revenue forecasting.

Effective management of deferred revenue involves detailed tracking and analysis to ensure that revenue is recognized accurately over the customer’s subscription period. Strategic deferred revenue management supports more accurate forecasting and financial planning. A deep dive into this can be found in our analysis at net revenue retention strategies.

Key Challenges in Revenue Timing for SaaS Companies

The timing of revenue recognition can present significant challenges for SaaS controllers and finance leads. Determining the exact point at which revenue should be recognized under ASC 606 can be complex, given the variety of customer contracts and service delivery models in the SaaS industry.

Revenue timing issues often arise from multi-element arrangements, where a subscription includes both software access and professional services. Accurately allocating revenue across different performance obligations requires detailed contract analysis and revenue scheduling. For a comprehensive overview, visit our resource on measuring and tracking time to value in subscription-based businesses.

Optimizing Revenue Recognition Processes: A Tactical Guide

Best Practices for SaaS Finance Teams

- Implement an automated revenue recognition and management system to ensure accuracy and efficiency.

- Regularly review and update revenue recognition policies to align with current accounting standards and business models.

- Enhance cross-departmental collaboration to ensure sales, finance, and operations are aligned on contract terms and obligations.

Adopting these practices not only streamlines revenue recognition processes but also strengthens compliance and financial reporting. Optimization of these processes is pivotal for the financial health and strategic planning of SaaS companies. Learn more about leveraging financial analytics for strategic advantage at Fincome’s pricing strategies.

Integrating ASC 606 into Your SaaS Financial Strategy

For SaaS controllers and finance leads, embedding ASC 606 principles into the core of your financial strategy is not just about compliance—it’s about gaining a strategic edge. Understanding the intricacies of revenue recognition SaaS, deferred revenue, and revenue timing under this standard can unlock insights into your business model, customer behavior, and revenue predictability.

Strategically integrating ASC 606 can transform compliance from a burden into a competitive advantage. For deeper insights into financial strategies, explore our resource on forecasting and financial planning.

Technology’s Role in Streamlining Revenue Recognition

Automating for Accuracy and Efficiency

Adopting the right technology is pivotal in managing the complexities of revenue recognition SaaS, deferred revenue, and revenue timing. Automation tools can significantly reduce manual errors, improve efficiency, and provide real-time insights into financial metrics.

Investing in specialized SaaS finance software is essential for achieving scalability and compliance. This technology enables you to manage contracts, recognize revenue accurately, and report financials in alignment with ASC 606. For an overview of technological solutions, read our article on key customer success metrics for SaaS.

Forecasting Revenue with Precision in the SaaS Model

The SaaS business model, with its recurring revenue streams, presents unique challenges and opportunities for revenue forecasting. The accuracy of your forecasts depends heavily on how well you manage and recognize revenue, taking into account deferred revenue and the timing of revenue recognition.

Accurate forecasting is crucial for strategic decision-making and investor relations. Leveraging real-time data analytics for forecasting can provide a competitive edge. Learn more about enhancing your revenue forecasting methods at our budget variance analysis guide.

Stress-testing Your Revenue Recognition Framework

Robust stress-testing of your revenue recognition framework is essential for navigating economic downturns and market volatility. SaaS companies must evaluate how changes in customer behavior, such as churn or downgrades, impact deferred revenue and the timing of revenue recognition.

This exercise not only uncovers vulnerabilities in your revenue model but also informs strategic adjustments to enhance resilience. By rigorously testing scenarios where customer commitments may change, finance leaders can better predict and mitigate the effects on revenue recognition and cash flow. For a deeper exploration of this topic, consider our insights on net revenue retention strategies.

Adapting Revenue Strategies for Emerging Markets

- Customizing billing cycles to match local payment behaviors and preferences can optimize cash flow and reduce deferred revenue complexities.

- Local regulatory requirements may necessitate adjustments in revenue recognition practices to ensure compliance while maximizing revenue potential.

- Understanding cultural nuances in business transactions can inform more effective revenue timing strategies, enhancing customer satisfaction and retention.

Entering new markets requires a tailored approach to revenue recognition SaaS, deferred revenue, and revenue timing to ensure both strategic alignment and local compliance. For SaaS companies looking to expand globally, adapting revenue strategies to fit local markets is key to unlocking growth and maintaining financial health.

Optimizing for Customer Lifetime Value (CLV) through Revenue Recognition Insights

Enhancing CLV with Strategic Revenue Recognition

Understanding the interplay between revenue recognition practices and customer lifetime value (CLV) offers SaaS companies a strategic lever for growth. By aligning revenue recognition SaaS, deferred revenue, and revenue timing with customer value creation, finance leaders can optimize for both compliance and customer success.

Insights gained from analyzing revenue patterns can help identify opportunities for upselling, cross-selling, and improving retention strategies—key components of maximizing CLV. This strategic focus not only supports financial performance but also drives a customer-centric approach to revenue management. For more on leveraging analytics for CLV optimization, visit our guide at SaaS financial forecasting.

As the SaaS landscape continues to evolve at an unprecedented pace, the strategic management of revenue recognition SaaS, deferred revenue, and revenue timing emerges as a critical differentiator for companies aiming to lead in their markets. Embracing a forward-looking approach to these aspects not only ensures compliance and financial integrity but also offers deep insights into customer value, driving both strategic decision-making and operational excellence. This nuanced understanding can unlock new levels of financial agility and competitive advantage, empowering SaaS companies to navigate the complexities of today’s business environment with confidence.

For finance leaders looking to elevate their revenue management strategies and harness the full potential of their financial operations, the journey begins with a commitment to best-in-class practices and technologies. By leveraging the right tools and insights, finance teams can transform revenue recognition from a compliance obligation into a strategic asset. To discover how Fincome can help your SaaS business achieve this transformation and to book a live demo with Fincome’s team, you’re taking the first step towards optimizing your revenue recognition processes for maximum impact and efficiency.

Frequently Asked Questions

How does deferred revenue impact financial forecasting?

Deferred revenue affects financial forecasting by representing future obligations to deliver services, which impacts cash flow and revenue recognition timelines. Accurate forecasting requires accounting for these obligations to understand future revenue and expenditure.

What are the key challenges in revenue timing for SaaS companies?

The primary challenge lies in aligning revenue recognition with the delivery of services over time, especially in multi-element arrangements that complicate the timing and amount of revenue recognized.

How can SaaS companies streamline ASC 606 compliance?

Streamlining ASC 606 compliance involves implementing robust systems for tracking performance obligations, customer contracts, and revenue schedules, alongside regular training for finance teams on the latest accounting standards.